1. Introduction

The fast-moving consumer

goods industry is one of the key contributors to the Indian economy. The FMCG

sector accounts for the fourth-largest sector in the economy, with household and personal care being the leading segment accounting for 50

percent of shares. The main growth drivers for FMCG have been increasing

income, changing lifestyles, increasing awareness, and easier access. Besides,

the trend toward sustainable products also influences consumers’ purchase behavior.

Dabur

India Limited is one of the leading fast moving consumer goods (FMCG) players

dealing in consumer care and food products. It is the 4 th largest FMCG company

in India and a leader in Ayurveda globally. Dabur operates in key consumer

products categories like Hair Care, Oral Care, Health Care, Skin Care, Home

Care and Foods.

The

company has various brand leaders in different market segments - Dabur

Chyawanprash (a health tonic) and Hajmola (a digestive tablet). Real, launched

during 1996-1997, has also successfully become the leader in the market. The

company has a wide distribution network, with a high penetration in both urban

and rural markets. It has its manufacturing presence across 9 countries.

Dabur

has identified 9 Power Brands – Dabur Chyawanprash, Dabur Honey, Dabur Lal

Tail, Dabur Honitus, Dabur Pudin Hara, Dabur Red Paste, Dabur Amla Hair Oil,

Vatika and Real fruit juice.

2. Literature

review

Bagchi.B

& Khamrui.B (2012) investigated the relationship between working capital

management and firm profitability and to identify the variables that most

affect profitability. Working capital management is considered to be a vital

issue in financial management decision and it has its effect on liquidity as

well as on profitability of the firm. In this study, we have selected a sample

of 10 FMCG (Fast Moving Consumer Goods) companies in India from CMIE database

covering a period of 10 years from 2000–01 to 2009–10. Profitability has been

measured in terms of return on assets (ROA).Cash conversion cycle (CCC),

interest coverage ratio, age of inventory, age of creditors, age of debtors and

debt-equity ratio have been used as explanatory variables. Pearson’s

correlation and pooled ordinary least squares regression analysis are used in

the study. The study results confirm that there is a strong negative

relationship between variables of the working capital management and

profitability of the firm.

S M

Imamul Hoque and Mohd Atif Afzal (2017), ‘An appraisal of financial performance

of the FMCG industry in India’. This study states that, there is significant

impact of sales on liquidity position of selected FMCG companies, there is no

significant impact of sales on solvency position of selected FMCG companies and

there is significant impact of sales on profitability position of FMCG

companies. The study included the time period of five years i.e., 2011-12 to

2015-16.

Tamragundi

& Vaidya (2016) says FMCG industry plays a significant role in shaping a

country’s economy and development. he FMCG sector has grown at an annual

average of about 11 per cent over the last decade. Their work examined the

relationship between profitability and liquidity on ten leading FMCG companies

in India for the period of 2005-06 to 2014-15. Profit is the propulsive element

of any investments in different projects and observed that for FMCG companies

there is not a dilemma between Liquidity and Profitability.

Shivanisinh

Shailesh Kumar Parmar (2017) in his research paper ‘A study on financial

efficiency of selected FMCG companies in India’, it evaluated various financial

ratios and provided conclusion upon 7 companies on the basis of financial

ratios. This study included seven FMCG companies and time period included in

this study is 10 years that is 2007-2015.

Patel,

Harish., Patel, Dr. V. B. (2018) aimed to analyze fundamental position of major

listed FMCG companies using ratios. The aim of study is P&G, NESTLE, ITC,

DABUR, and HUL. Analysis was done using past three-year computed date of income

Margin Ratio, profits margin, Price to Earnings, Debt to equity ratio, Dividend

payout ratio, Earnings per share starting April 2016 to March 2018.This study

provides a specific presentation of data and guidelines which can help a fresh

investor likewise as a venture investor to understand vital aspects of

investing. This study helps to the investors to make a decision on a secure

investment and to identify the expansion opportunities within the long run.

3. Objectives:

1. To

know about the Dabur India Ltd.

2. To

analyze the financial position of Dabur India Ltd. company.

4.

Research Design

The present study is a descriptive study which tries

to analyze financial position of the Dabur India Ltd. Company. The research

undertaken was quantitative research as it was concerned with numerical,

applied statistics, and use of graphs and tables.

5.

Data Collection

The

data for this project is collected with the help of only secondary data.

6.

Source of Data Collection

The study is based on secondary data which is

collected from the published financial statements viz., Trading and profit and

loss account and balance sheet contained in the annual report of the selected

Dabur Ltd.

7.

Period of the Study

The study period

cover 2 years for 2022-23 to 2023-24.

8. Data

Analysis

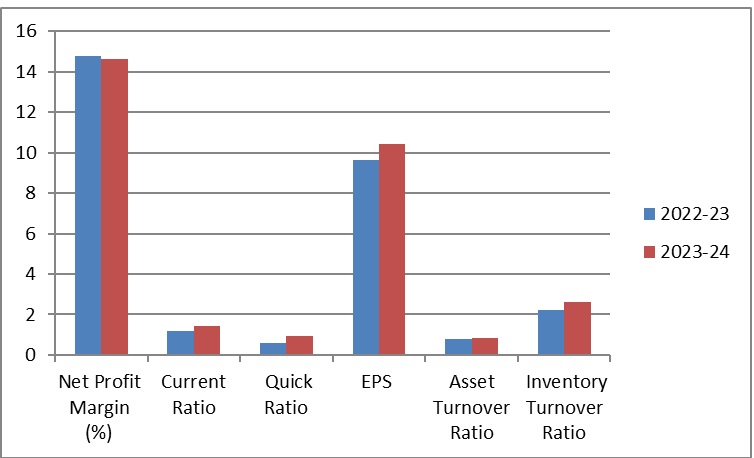

|

Year

|

Net Profit Margin (%)

|

Current Ratio

|

Quick Ratio

|

EPS

|

Asset Turnover Ratio

|

Inventory

Turnover Ratio

|

|

2022-23

|

14.76

|

1.18

|

0.61

|

9.64

|

0.8

|

2.22

|

|

2023-24

|

14.6

|

1.45

|

0.94

|

10.4

|

0.86

|

2.61

|

The

graph shows values of 6 accounting ratios for Dabur Ltd. and Net Profit Margin

of Dabur Ltd. is the highest.

In

the above table the Net Profit Margin (%) of Dabur Ltd. for the year 2023-24 is

decrease than the previous year. A higher profit margin indicates a more

profitable company that has better control over its costs.

The current Ratio (%) of Dabur Ltd. for the year

2023-24 is increase than the previous year. It shows the sound financial

position of Dabur ltd. The quick ratio for Dabur India Ltd. is almost 70%

increase 0.60 to 0.94 respectively for the year. We

infer that Dabur has the ability to pay off its liabilities.

Earnings per Share have risen from 9.64 in 2022-23 to

10.4 in 2023-24. This ratio indicates the ability of the firm’s assets to

generate operating income. As a rule of thumb, the higher this ratio is the

better. It is important to realize that this ratio shows the return

shareholders are actually achieving on their investment, using current market

value for listed shares.

The Asset turnover of Dabur Ltd. for the year 2023-24

is increase than the previous year. We

conclude that it uses its assets very effectively to generate revenue or sales.

In the above graph, Inventory Turnover Ratio is shows

2.61. This ratio indicates whether investment in inventory is within proper

limit or not.

9.

Limitation of the study

1.

This study is mainly depends on secondary data in annual report of Dabur India ltd.

2. The study is

based on analyzing the financial position of Dabur India ltd only. Hence it is

not applicable to other companies.

10. Conclusion

The

researcher investigated and analyzed the financial performance, liquidity, and

profitability position of Dabur India Ltd. by applying various accounting

ratios. On studying the financial performance analysis of Dabur India Ltd. for

a period of two years from 2022-23 to 2023-24, the study reveals that the

financial performance is better. However it needs to minimize the operating

expenses to get high net profit margin. Dabur India has efficiently control its

current assets and liquid assets to pay its current liabilities so that the

creditors of the company feel secured about the repayment of their amounts by

the company. Sales turnover has to be improved by checking expenses that

influences the sales. Inventory management of the concern is satisfactory.